Uniswap Overview

What is Uniswap?

Uniswap is an Ethereum-based exchange that‘s fully decentralized and uses AMM trading model instead of CLOB.

The Uniswap platform was built in 2018 on top of the Ethereum blockchain, which makes it compatible with all ERC-20 tokens and infrastructure such as wallet services like MetaMask and MyEtherWallet.

Uniswap is also completely open source. It even allows users to list tokens on the exchange for free. Normal centralized exchanges are profit-driven and charge very high fees to list new coins, so this alone is a notable difference. Because Uniswap is a decentralized exchange, it also means users maintain control of their funds at all times as opposed to a centralized exchange that requires traders to give up control of their private keys so that orders can be logged on an internal database rather than be executed on a blockchain, which is more time consuming and expensive. According to the latest CoinGecho statistics(DEX Ranking), Uniswap(all versions/chains-combined), Uniswap takes up to 50.8% (as of 2022-June-1) market share in terms of trading volume.

Uniswap Areas:

- ++Uniswap Labs++: The company which developed the Uniswap protocol, along with the web interface.

- ++The Uniswap Protocol++: A suite of persistent, non-upgradable smart contracts that together create an automated market maker, a protocol that facilitates peer-to-peer market making and swapping of ERC-20 tokens on the Ethereum blockchain.

- ++The Uniswap Interface++: A web interface that allows for easy interaction with the Uniswap protocol. The interface is only one of many ways one may interact with the Uniswap protocol.

- ++Uniswap Governance++: A governance system for governing the Uniswap Protocol, enabled by the UNI token.

Differences Between Uniswap and Centralized Exchange?

Uniswap identifies itself as the pioneer in AMM-based DEX and puts AMM Approach and Permissionless as the differentiators. (for AMM/Permissionless, please refer to other sheets in research folders, will focus on business structure perspectives here.)

Fee Structure:

Uniswap breaks down fee structure into below arrangement:

- Swap Fees

- Pool Fees Tiers

- Finding The Right Pool Fee

- Protocol Fees

Detailed official explanation could be found here

In general, from users’ perspectives, we could summarize the fee structure as below:

*0.05% fee tier: Best for stable pairs

The 0.05% fee tier is ideal for token pairs that typically trade at a fixed or highly correlated rate, such as stablecoin-stablecoin token pairs (e.g. DAI-USDC). LPs take on minimal price risk in these pools, and traders expect to pay minimal fees.

*0.3% fee tier: Best for most pairs

The 0.30% fee tier is best suited for less correlated token pairs such as the ETH-DAI token pair, which are subject to significant price movements both to the upside and downside. This higher fee is more likely to compensate LPs for the greater price risk that they take on relative to stablecoin

*1.0% fee tier: Best for exotic pairs

The 1.00% fee tier is designed for exotic assets, where LPs take on extreme price risk (e.g. ETH-GTC). Relevant assets are those that are particularly subject to monotonic price movements.

How Uniswap Works?

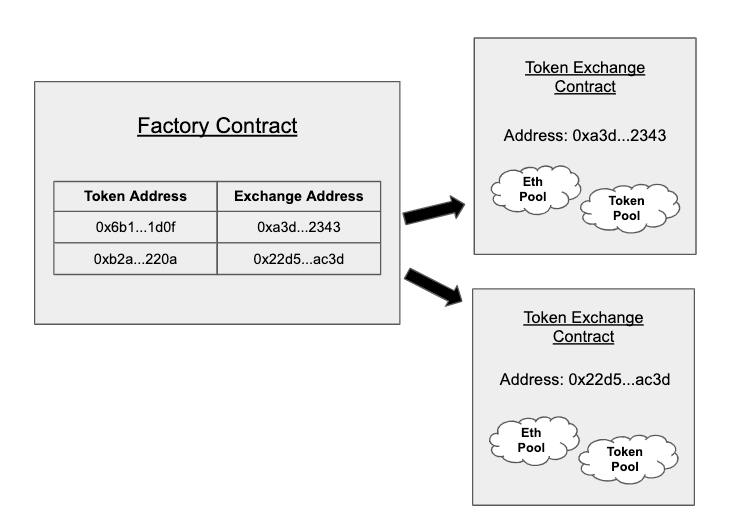

Uniswap runs on two smart contracts; an “Exchange” contract and a “Factory” contract In this instance, the factory smart contract is used to add new tokens to the platform and the exchange contract facilitates all token swaps, or “trades.” Any ERC20-based token can be swapped with another on the updated Uniswap V.2 V.3 platforms.

What Makes Uniswap Unique?

Timing (+ then-Unprecedented Product/Service in DeFi) -

(ERC-20 Token Pioneer)

ERC20 tokens are the most common type of token built on top of Ethereum. They are fungible in nature, meaning that there isn’t a distinction between individual tokens. This contrasts with ERC721 tokens which are non-fungible tokens (NFTs) such as cryptokitties.

ERC-20s can be thought of as the most simple unit of account for a wide range of use cases including currency, rewards points, debt slips, interest accruing bonds, and much more. They are also highly divisible and can be sent in small increments. Since this type of token is so pervasive, it is important to develop a simple way of swapping between them.

Editorial Comment:

=> In Nov. 2018, there’s no other DEXs to accommodate ERC-20 tokens being traded, as Ethereum has been gradually adopted by market players, so Uniswap becomes the go-to marketplace. Consequently, the feature marked Uniswap’s first success pillar.

Contracts Structure + Listing Fee - In addition to the more attractive UI(than Curve…obviously), Uniswap standardizes how ERC20s are exchanged with a set of smart contracts. Users could design an interface that connects to these contracts and instantly be able to start swapping with everyone else that is using Uniswap.

Below are two different types of contracts that make up Uniswap.

-

The first is known as an Exchange contract. Exchange contracts hold a pool of a specific token and Ether that users can swap against.

-

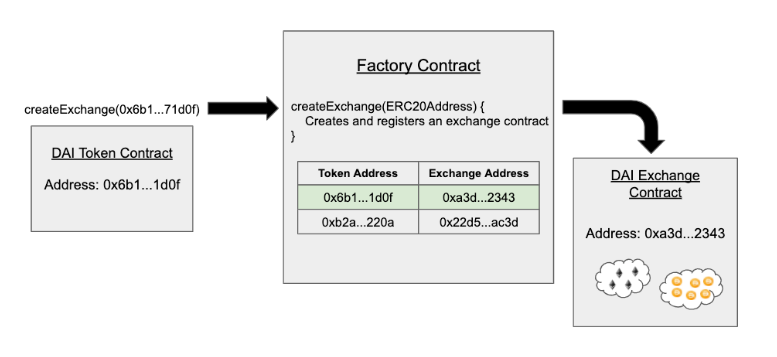

The second kind of contract is the Factory contract which is in charge of creating new Exchange contracts and registering the ERC20 token address to its Exchange contract address.

Uniswap charges NO listing fees to add a token, instead anyone can call a function on the Factory contract to register a new token. The screenshot below is an example of when DAI was added to Uniswap. Someone first called the createExchange function in the Factory contract with DAI’s contract address. Then the Factory contract checks its registry to see if an Exchange contract has been created for that token address. If no Exchange address is listed, the factory contract deploys an Exchange contract and records the Exchange address in its registry.

Editorial Comment:

=> Similarly, the “paired”-contract structure with NO token-listing fees also provide users strong incentives to both list new tokens and provide liquidity(no matter maker or taker). It’s a bold move back in 2018/2019 as listing fee is one of the most important revenue sources for exchanges. Although it’s difficult to estimate how many costs for the strategy, it does help Uniswap gain a firm foothold in the competitive DEX markets.

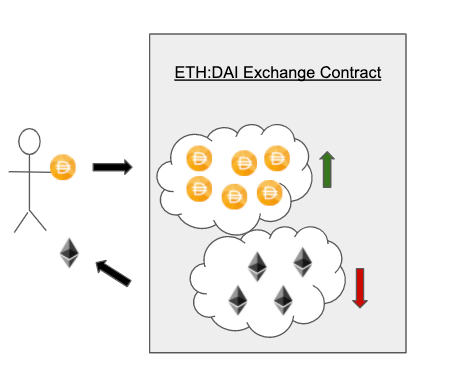

AMM-based Liquidity Model -

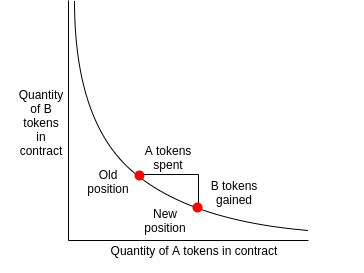

Unlike CEX such as Binance and CoinbasePro, Uniswap uses the Exchange contracts to pool both ETH and a specific ERC20. When trading ETH for a token, ETH is sent to the contract’s pool and the token is given back to the user. As a result, the user doesn’t need to wait for a counterparty in order to exchange or worry about specifying a price. Since anyone can list a token(for free) and users don't need to worry about matching with someone else, it is very easy to avoid any bootstrapping issue when first launching a token. The amount that is returned from swapping is based on an automated market maker formula. The graph below helps illustrate how the formula works. Essentially, the amount that is returned to you is based on the ratio of ETH to token in the pool. No matter the size of a swap, the user is guaranteed to have their trade executed because the more of an asset that you add to one side of the pool, the further along the curve it pushes you for the other asset. Meaning the larger the order relative to the pool, the worst rate you will receive as the ratio moves along the curve.

Editorial Comment:

=> (Note: From a personal perspective, I believe AMM is more like a “short-term workaround” to fix liquidity problems before the central limit order book model becomes mature in DeFi word. After all, real bids/asks with funded capital in each price level are the most intuitive, logical and riskless solution to trade.)

Even though DeFi has grown rapidly in the past 3 years and DEX users are also more active, it is still often the case that liquidity at underlying DEX as a whole and/or specific trading pair is poor. The huge bid/ask spreads and slippage are culprits making users away from DEX. Hence, to attract more users and price/vol liquidity in the DEX market, AMM is the most reasonable and cost-effective(building CLOB is expensive) innovation. At the same time, AMM properly serves the needs of high frequency traders which in turn could offer more liquidity to form a positive flywheel.

Again, let’s analyze Uniswap’s success along with timeline and DEX development, the Zero Listing Fee + AMM-Model approach is without doubt the key as it indeed fixes the pain point for both DEX market and market participants. Surely, Uniswap keeps improving with market/competitor evolutions such as Vampire Attach by Sushiswap. However, I think the right fit foundation in the early stage is the most important factor of the win. Consequently, among all the functions/capabilities DuraFi has, we must carefully choose one/few of them to fix the market bottleneck.

H2H Comparison with Competing DEXs -

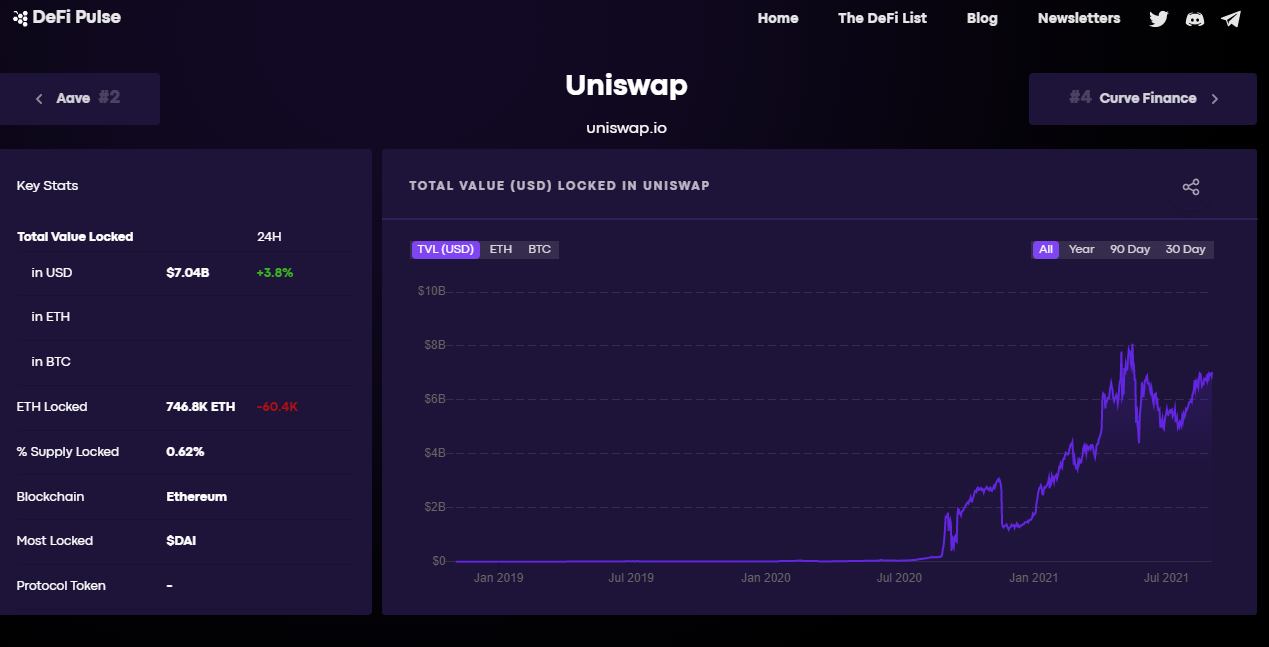

From above inferences via business analysis perspective, we could pair with statistics to validate the effectiveness from highsight view. See below Uniswap statistics from DeFi Pulse.

Indicator Comparison -

From Nov. 2018, from the business actions conducted by Uniswap, we could easily observe the TVL kept soaring.

- Nov. 2018: $211K

- Mar. 2019: $6.7M

- Jun. 2019: $17.6M

- Sep. 2019: $12.1M

- Dec. 2019: $12.4M

- Mar. 2020: $17.0M

- Jun: 2020: $44.3M

– DeFi Summer –

- Sep: 2020: $2.1B

- Dec. 2020: $1.78B

- Mar. 2021: $4.56B

- Jun. 2021: $5.48B

- Sep. 2021: $7.01B

From Nov. 2018 to Sep. 2021, Uniswap TLV growed 33,222x.

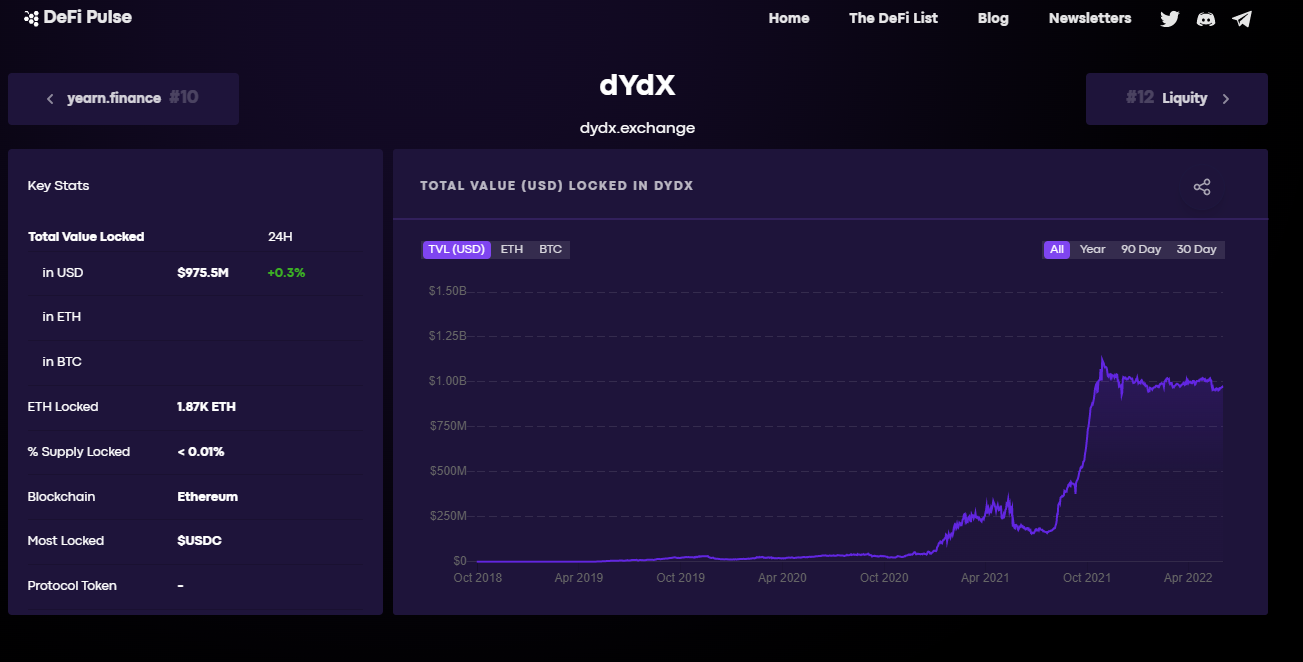

Compared with dYdX(DuraFi’s opposing force, although it’s CLOB-based, we could still take it to be compared and get the market sense as they both started business at the end of 2018.) From Mar. 2019 to Sep. 2021, dYdX TLV only grew 4,823x. Although it definitely is a remarkable figure, the growth speed and amount are obviously weaker than Uniswap.

- Mar. 2019: $144.1K

- Jun. 2019: $7.86M

- Sep. 2019: $22.48M

- Dec. 2019: $13.38M

- Mar. 2020: $19.42M

- Jun. 2020: $34.48M

– DeFi Summer –

- Sep. 2020: $30.57M

- Dec. 2020: $61.03M

- Mar. 2021: $237.96M

- Jun. 2021: $179.4M

- Sep. 2021: $695.05M

From TVLs, the most representative indicator, comparison between Uniswap and dYdX, leading AMM and CLOB respectively. We could draw conclusions as below:

Editorial Comment:

-

AMM-based DEX could attract more TVL and trading volume(as the beginning shows) from the 2019~2021 3-Year time period. Currently, we don’t observe apparent signs for change. I, personally, credit the fact to AMM-based Model + No Listing Fee structure.

-

At the current stage, the number of users and trading volume are not enough to sustain a complete and liquid market in DEX. Hence, we could see that professionals/institutions flow to AMM-based DEXs as they are the only marketplace to execute trades properly with controllable slippage and spread. Also, those users are naturally with much bigger trading volume and frequencies. Moreover, to attract LPs providing funds in pools, the liquidity mining rewards kept luring more LPs in the ecosystem; on the other hand, CLOB-based DEX could only offer a fee discount scheme to attract users. Nevertheless, the approach is much more passive and there are no actual rewards there(only saving money instead of earning).

Reward Program Comparison(User Acquisition) -

For Uniswap, the reward programs could be divided into 2 categories:

- Uniswap Protocol Scheme(as below):

The Setting

Term definitions as follow. The following parameters compose the elements in underlying schemes:

- rewardToken: Perhaps the most important parameter, would-be incentivizers must pick the ERC20 token which they would like to distribute as a reward for providing liquidity.

- pool: The address of the Uniswap V3 pool in which liquidity must be provided.

- startTime: The UNIX timestamp at which rewards start to be distributed.

- endTime: The UNIX timestamp at which rewards start to decay.

- refundee: The address which has the right to reclaim any leftover rewards after the Incentive has concluded.

Finally, every Incentive has an associated reward, the total amount of rewardTokens that are allocated to be distributed over the lifecycle of the program.

Reward Math

Recall that Incentive creators pick a reward amount and a program duration. This directly corresponds to picking an amount of rewardTokens to distribute per second; this is called reward rate. So, for every second between startTime and endTime, a constant amount of tokens are distributed proportionally among all in-range liquidity at that second. Crucially, this counts all liquidity, not just liquidity that opts in to participating in the program. So, incentive creators should pick a reward rate that they deem worthwhile to distribute across (potentially) all in-range LPs for the duration of the program.

Staking

The first action a user must take in order to begin participating in an Incentive is to deposit their position NFT into the canonical staking contract address, effectively temporarily giving custody over their NFT to this contract. This is necessary because the staking contract needs to be able to guarantee that liquidity cannot be removed from NFTs participating in the program. Once deposited, a user may then stake their NFT into any number of active Incentives for the Uniswap V3 pool their NFT is tied to (note that this can happen atomically with an initial deposit). Staked NFTs then immediately start to earn rewards, according to the algorithm outlined above. Users may periodically claim accrued rewardTokens while the program is ongoing, or wait to claim until the program has concluded to minimize overhead.

Program Conclusion

There are two conditions that must be met for a program to be considered concluded:

- block.timestamp >= endTime: In other words, the program's duration must have expired. However, this doesn't mark the official end of the program, as some users may still be participating right up until this endTime boundary and beyond, to maximize their rewards. This leads directly to the second condition.

- All NFTs must be unstaked: A program can conclude only when every NFT which participated in it is unstaked. To ensure this is always possible, after the endTime of a program anyone may unstake any NFT (though of course they may not claim outstanding rewardTokens due to the NFT owner). This ensures that even if all users do not unstake themselves, someone can unstake them manually so that the program can end.

It's important that most or all programs fully conclude, primarily so that the refundee can reclaim any unallocated rewards. Recalling that the reward rate is the same across all in-range liquidity. However, only program participants may actually claim accrued tokens, so it's likely that all programs will end up with a balance of rewardTokens that cannot be claimed. Consequently, refundees will typically be incentivized to bring programs to an official conclusion. This slightly cumbersome design is a consequence of the difficulty of consistently allocating rewards proportional to Uniswap V3 liquidity.

A final note: stakers who remain in the program after endTime may actually see their rewards marginally augmented or (more likely) gradually diluted. The magnitude of these changes depend on stakers' share of the total active liquidity, the time spend staked after endTime, and the sequence of unstaking. In the worst case, rewards decay proportionally to the duration. For example, at 2x the duration, 50% of rewards could remain, at 3x, 33% could remain, etc. While somewhat complex, this behavior can largely be ignored from a game-theoretic standpoint. Stakers should simply attempt to unstake and claim rewards as soon as possible after endTime, an outcome that is likely in any case, as refundees will be eager to reclaim leftover rewards, and mass unstake stragglers.

- Uniswap x Other Protocols(as below examples):

(1) Kleros Tokens Reward Program - Securing Uniswap with Decentralized Lists

As the Kleros Token Curated Registry nears 500 submissions, Kleros has a fully decentralized list curation mechanism allowing for the simple addition of tokens with ticker, logo, and respective contract address to be vetted by the overall community

This gives users a basic level of security when interacting with Uniswap tokens and helps to root out the malicious copycat scam attempts we've seen in the current DeFi hype phase.These submissions, once registered, are then able to have a number of attached badges which specify far more detailed information about the project.

For example, the ERC20 badge, when accepted, gives users peace of mind that the token conforms to a proper ERC20 standard. This can help to avoid failed transfers or lost funds from improper development practices.

A new rewards program will be opened for those adding tokens to the list, successfully removing tokens and submission of ERC20 badges. Those will be distributed at the beginning of each month, starting in October and running until further notice.

For example: If there are 150 submissions in the given month, this would equal 100000PNK / 150 = 666PNK per submission.

If there are 100 submissions or below, the following rules apply.

- 1000 PNK for tokens successfully submitted or removed, up to 100 per month.

- 3000 PNK for ERC20 badges of ERC20 tokens with at least 100k$ of liquidity on Uniswap (at the end of the month), up to 100 per month.

- Rewards will be paid out the following month based on acceptance time to the list.

(2) Lattice Exchange - Uniswap Liquidity Incentive Program The Liquidity Program will commence on March 10th, 2021 with rewards being distributed at the end of each month.

Liquidity providers accrue rewards based on their percentage share of the overall liquidity pool. The rewards are paid in LTX to every liquidity provider that locks ETH and LTX on Uniswap for at least 30 days. These rewards are in addition to the normal 0.3% fee liquidity providers automatically accrue from uniswap transactions.

To participate, users have to whitelist your address, between now and March 11th, and add liquidity to the Lattice Uniswap trading pair. To qualify for rewards, liquidity has to be provided for at least 30 un-interrupted days. If you remove your liquidity from the pool prior to the 30 day mark (at any time) your previous progress is erased.

This rewards program will run for a minimum of 90 days and may be extended on a month-to-month basis. We reserve the right to cancel or modify the liquidity program at any time.

Qualification requirements *To qualify you need to provide at least 1 ETH of liquidity, plus 1 ETH worth of LTX tokens.

*Each qualifying liquidity add is only eligible for rewards 30 days after they are added.

*If you remove liquidity at any point, your previous liquidity contribution is disqualified. In this case you must wait 30 days from the next time you add qualifying liquidity to qualify for rewards.

*Each whitelisted and qualifying liquidity provider accrues rewards based on their percentage of pool contribution.

For dYdX, the reward programs are more focused on its own protocols. Also, as it’s protocol-concentrated, it is easier to calculate the costs and corresponding effects such as trading volume & revenue growth.

Please refer to the sheet for details.

After comparing the campaigns, we could draw conclusions as below:

Editorial Comment:

-

Compared with Curve.fi, both Uniswap and dYdX have disorganized reward schemes. Each of which is fairly independent and not capturing value(then distributing back).

-

From the examples listed, those campaigns are actually beneficial to Uniswap’s intrinsic values but just letting new protocol/project dropping Uniswap names to attract users via UNI. Surely, I would not deny it has zero values to Uniswap as all those campaigns are marketing activities to enhance Uniswap visibility in the DeFi field. It’s critical as new DeFi joiners grew exponentially in the past 3 years. If new joiners could hold UNI from the underlying reward schemes, it could aid Uniswap’s expansion for sure.

-

Compared with Uniswap, dYdX reward schemes are still little better as they are more focused on dYdX protocol itself which make users easier to stick to the platform. For example, if a user just uses other protocols to earn UNI, it basically has no positive effects to Uniswap.

-

Thus, given the disorganized reward schemes and primitive tokenomics, it is reasonable to credit their success more on competitive core exchange protocol capability, timing, differentiated functions and marking/support in social media(such as Discord, Telegram, IG, FB, LinkedIn…etc). From prospect users' perspectives, it is nearly impossible to research all protocols, analyze yield payout and then take actions. People would just choose the most accessible or well-known platform first. If the yield difference is not that significant, users would still stay put due to stickiness.